Buy Now Pay Later

Offer instant credit lines as a payment method on merchants’ e-commerce platforms. This type of loan allows customers to purchase a product immediately and break their payment into installments with the same value, usually without interest rate.

Main Advantages

End to end solution which provides the ability to configure specific scoring models as core engine of BNPL and reliable KYC processes for non-clients.

Ready to implement white-label BNPL software solution for lenders to integrate on merchants' e-commerce platforms as a payment method which includes our suite of credit solutions.

Improve the current scoring model performance, which will support the reduction of default behavior and increase of loan origination and profit.

The credit functionalities are open to partners through API’s and widgets that they can integrate within their own systems and interfaces that support their business model so lenders can engage across the entire purchasing journey.

Ready to implement white-label BNPL software solution for lenders to integrate on merchants' e-commerce platforms as a payment method which includes our suite of credit solutions.

Improve the current scoring model performance, which will support the reduction of default behavior and increase of loan origination and profit.

The credit functionalities are open to partners through API’s and widgets that they can integrate within their own systems and interfaces that support their business model so lenders can engage across the entire purchasing journey.

How it Works

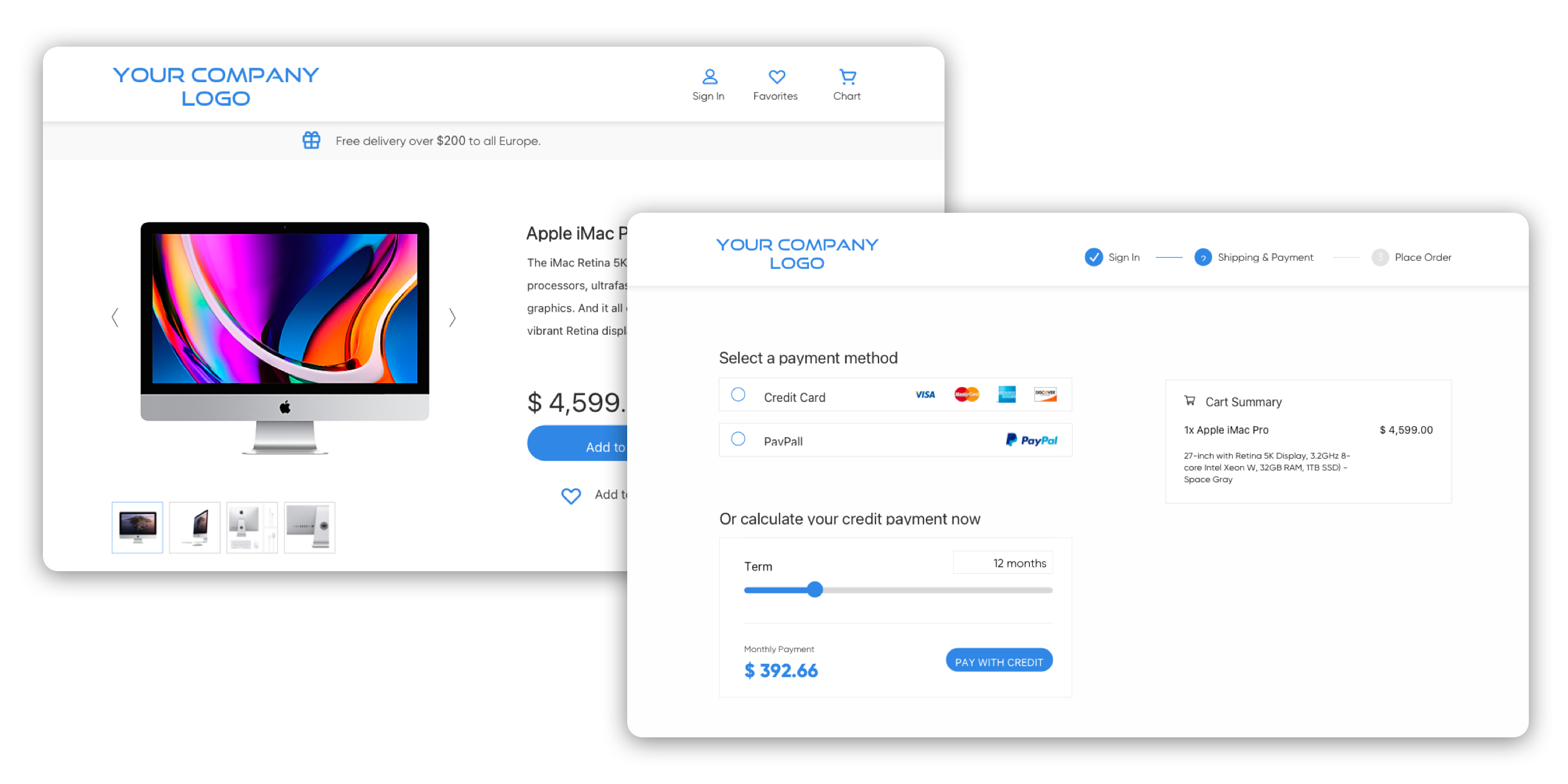

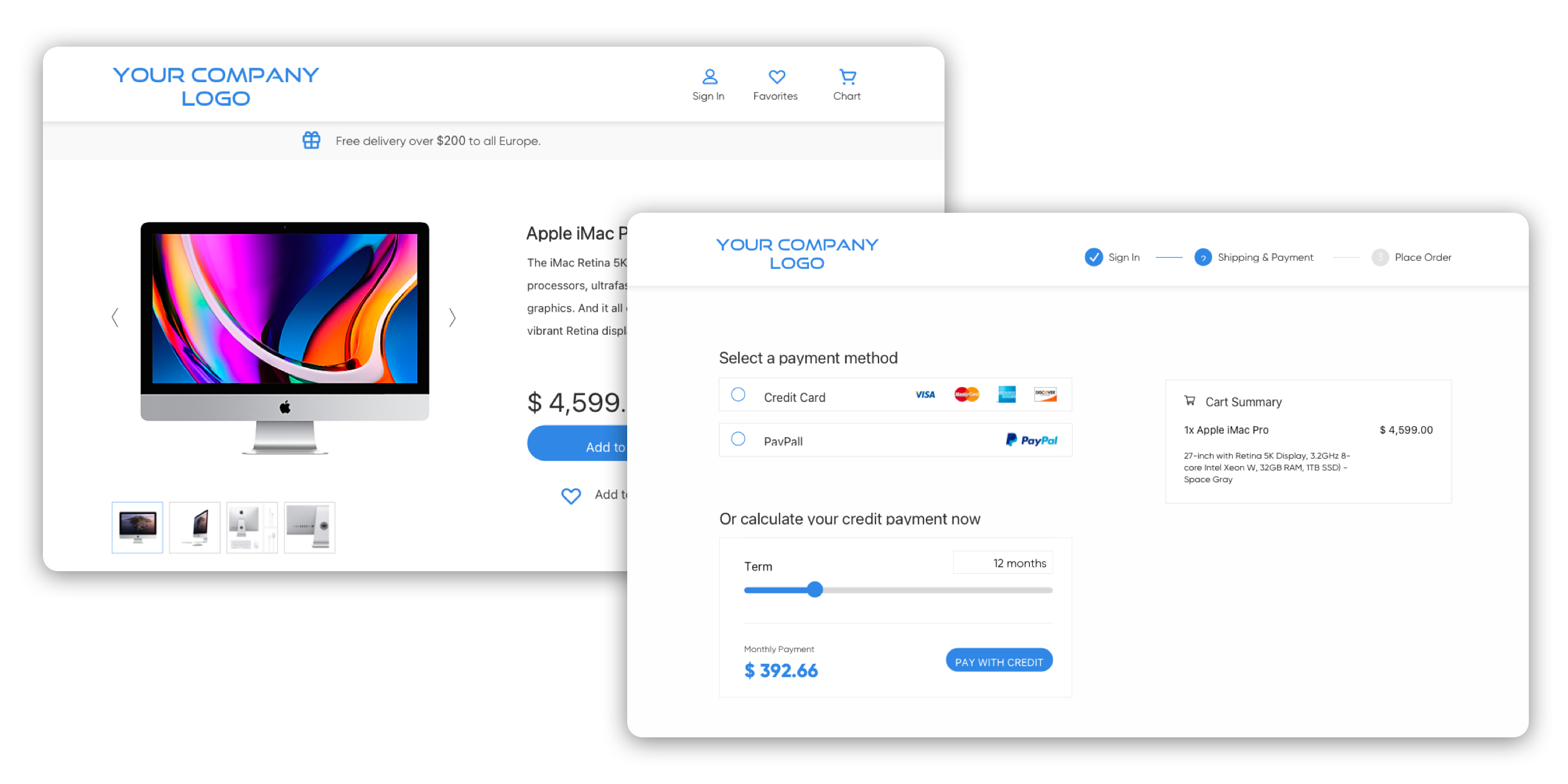

Checking out of merchants' e-commerce platform, the client selects the BNPL payment option and you can leave the credit process in our hands.

When clients are purchasing a product at point of sale (POS) physical or online merchants (e-commerce) a short-term loan is shown as a payment option. The payment conditions such as term, schedule and down payment are presented to customers.

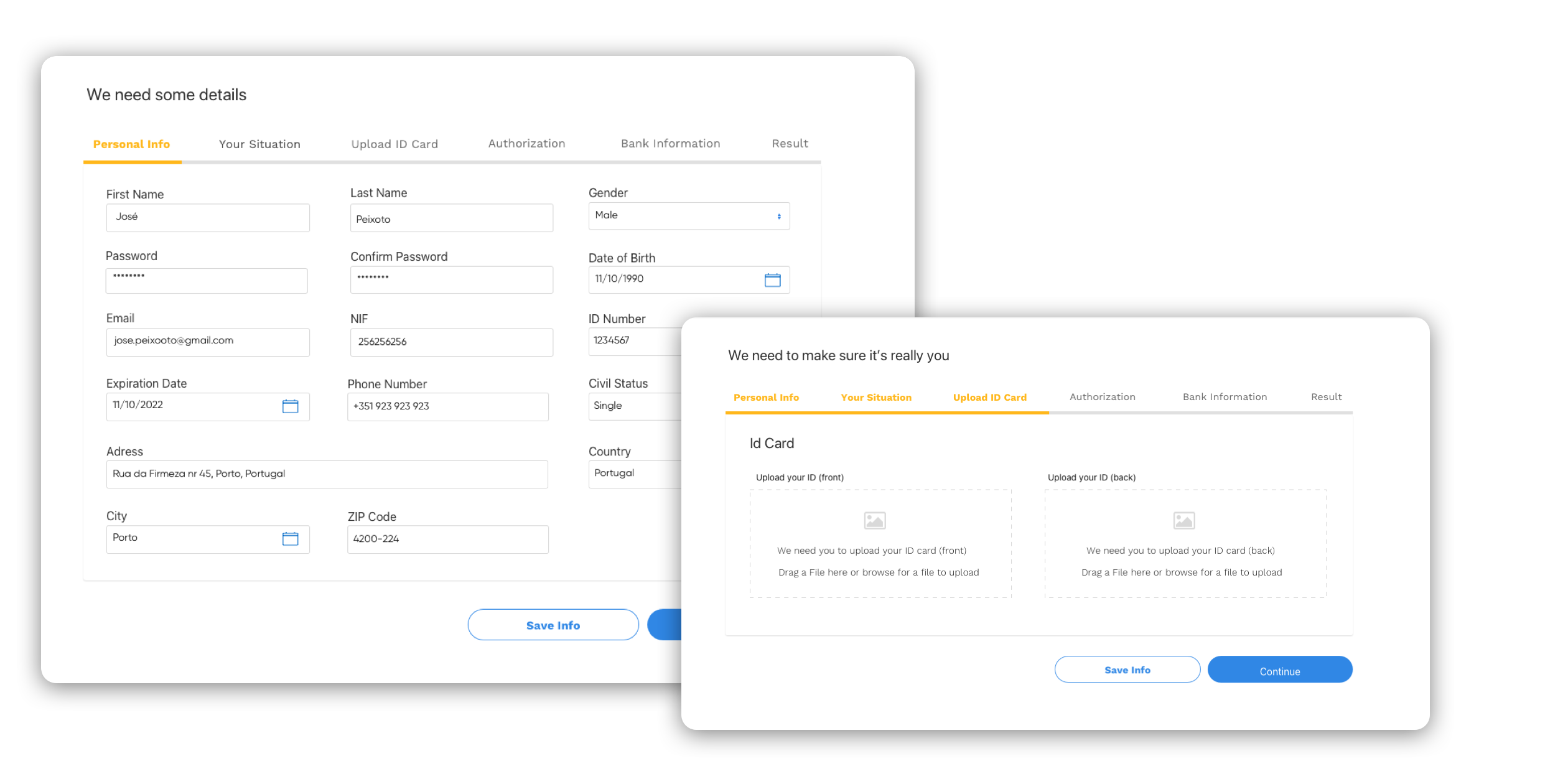

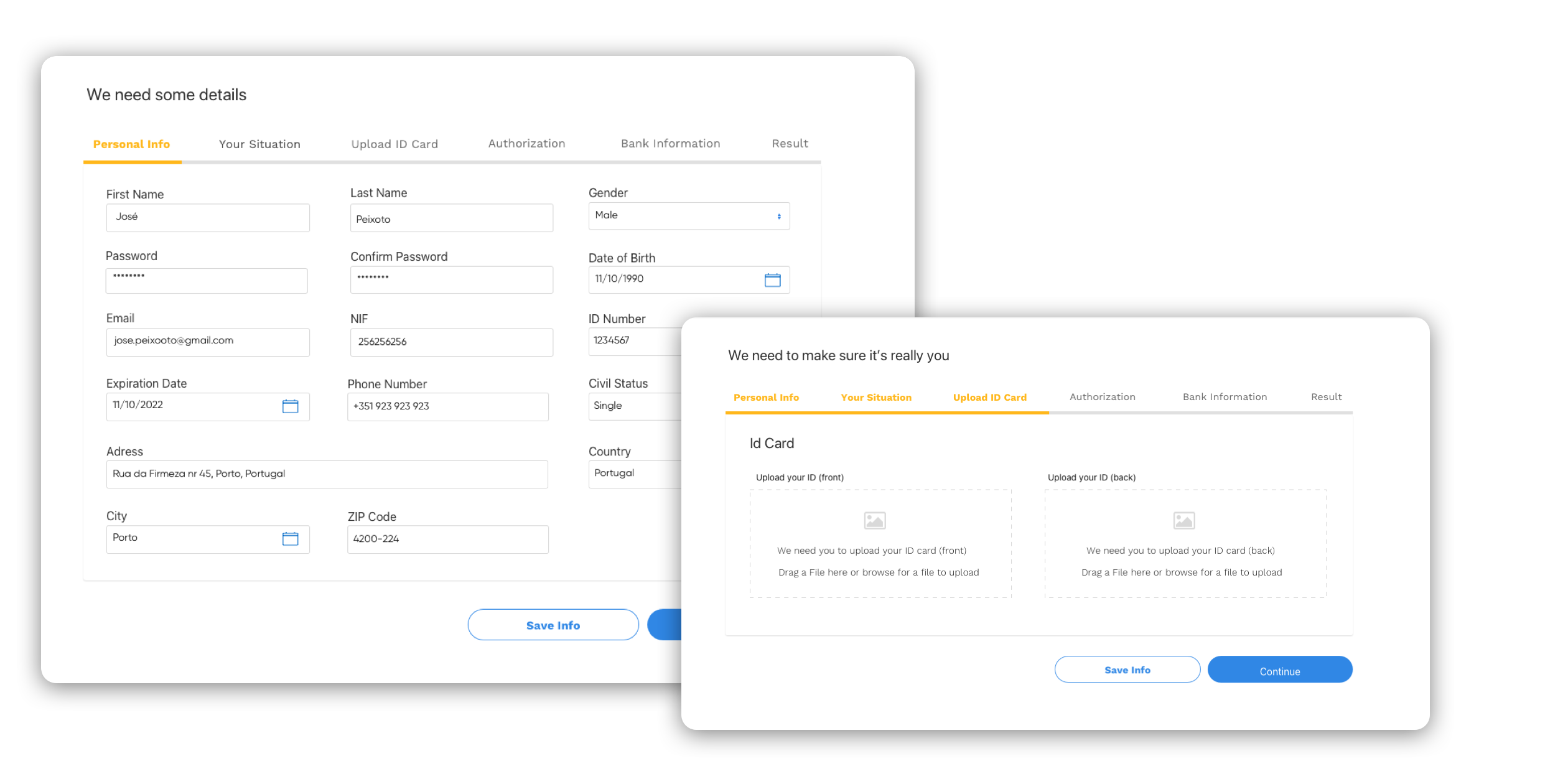

If the customer is new for the BNPL Provider, all data can be collected from diverse external sources, such as Core Banking, Bank Statements (PSD2), Central Credit Register (CCR), Credit Bureau and Other Systems which will be automatically validated to prevent frauds (KYC, AML). If not, the client just has to login into the BNPL provider’s platform.

If the customer did the registration, ITSCREDIT calculates the scoring grade and informs about the credit decision and corresponding limit, if applicable. If the customer did the logon, a credit pre-approval decision is presented and if positive he can proceed with the purchase.

Once all previous steps are successfully executed, the loan application process is completed, and the money is disbursed to the merchant's account. The down payment is paid and the remaining installments will be paid to the BNPL provider.

System Functionalities

This solution provides a simulation widget on merchants' e-commerce platforms which will lead the customer from the onboarding all the way up to the digital signature and disbursement.

-

Easy integration

The credit functionalities are open to partners through API’s and widgets that they can integrate within their own systems and interfaces

-

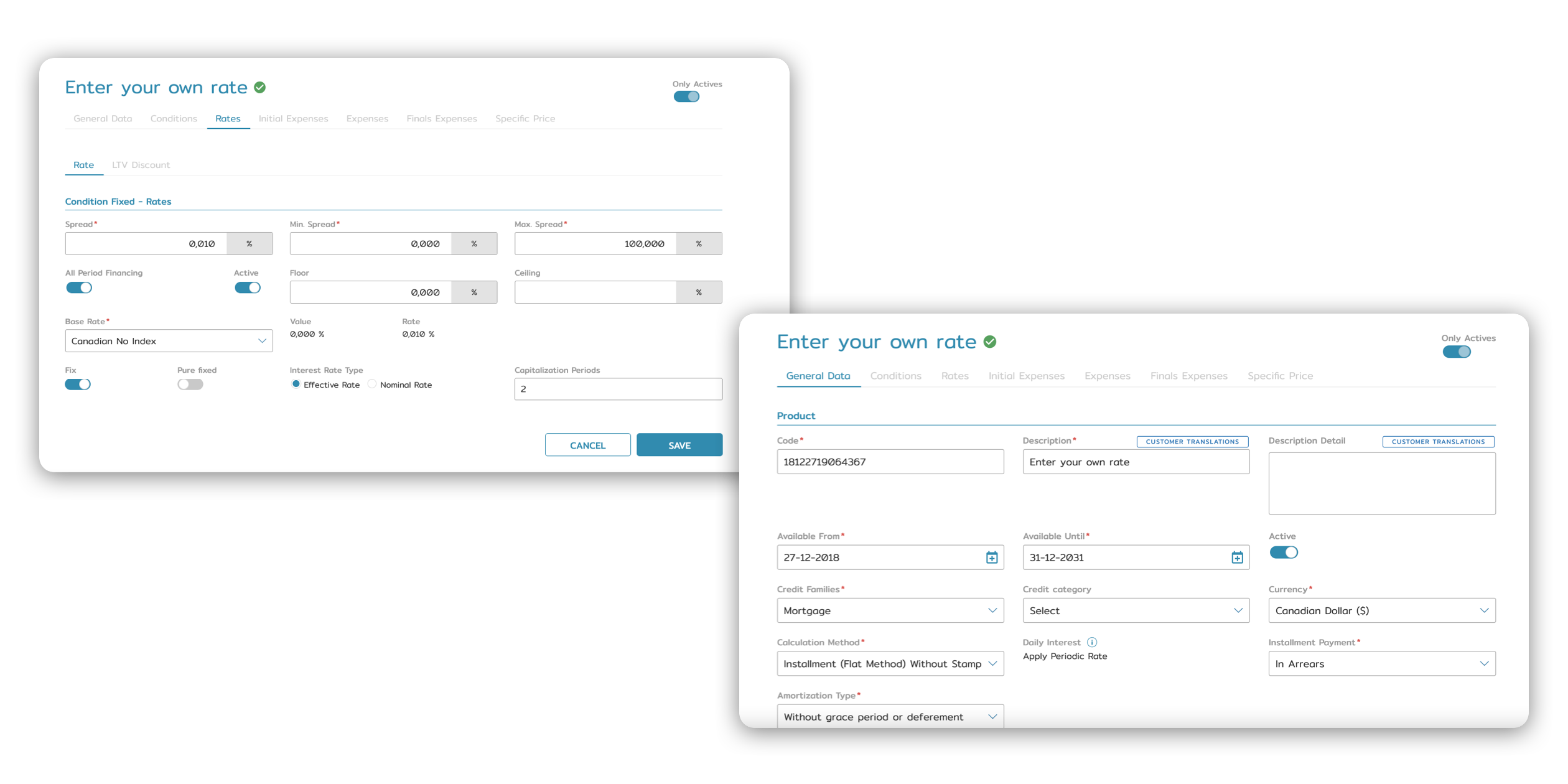

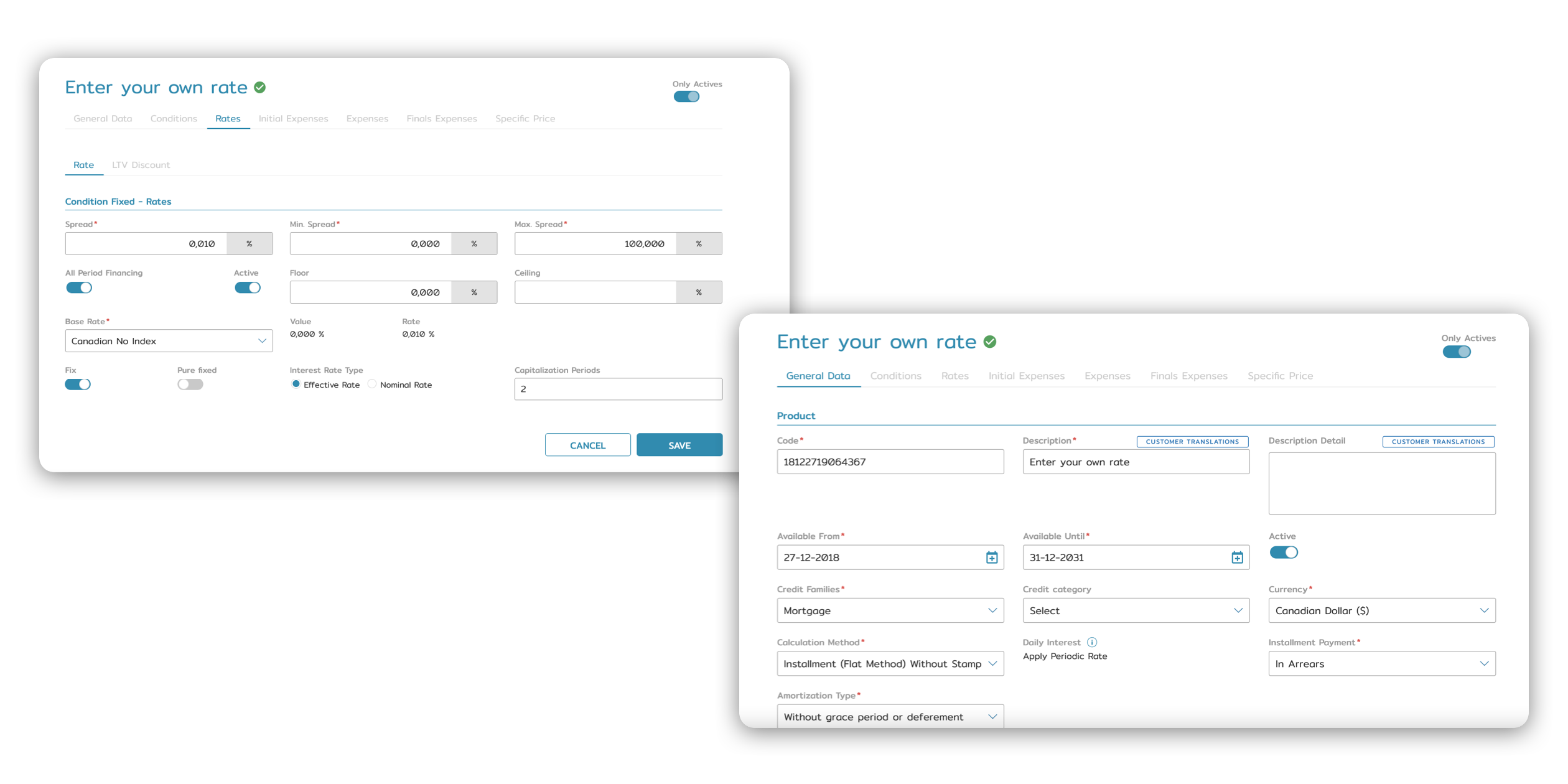

No-code solution

Highly flexible and easy to use Marketing module (within Credit Workflow) allowing product teams to create and manage new innovative products without IT support.

-

Onboarding (KYC, AML)

To non-customers, the user can create a new account, inserting his personal and financial data which will be automatically validated to prevent frauds.

-

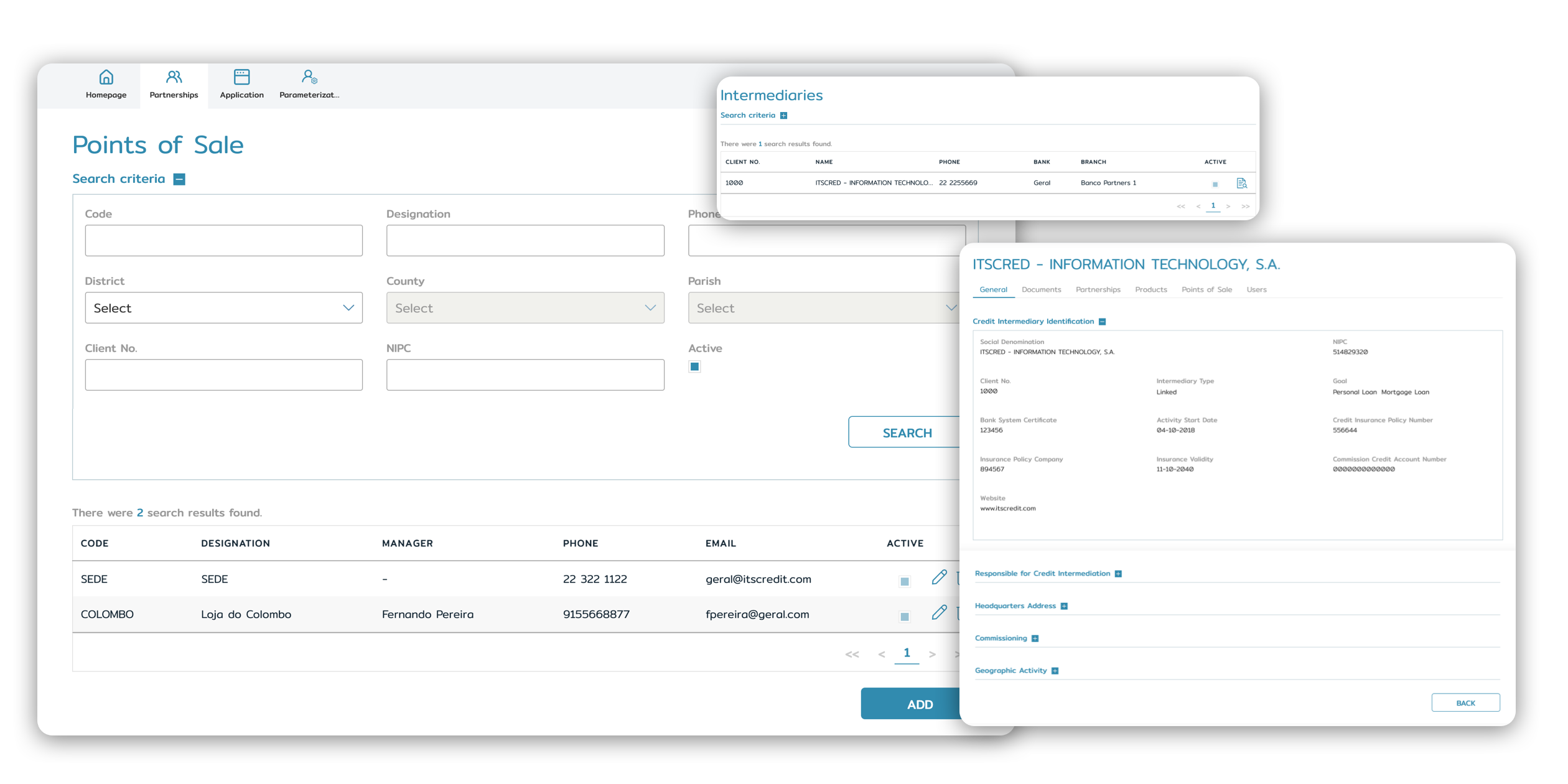

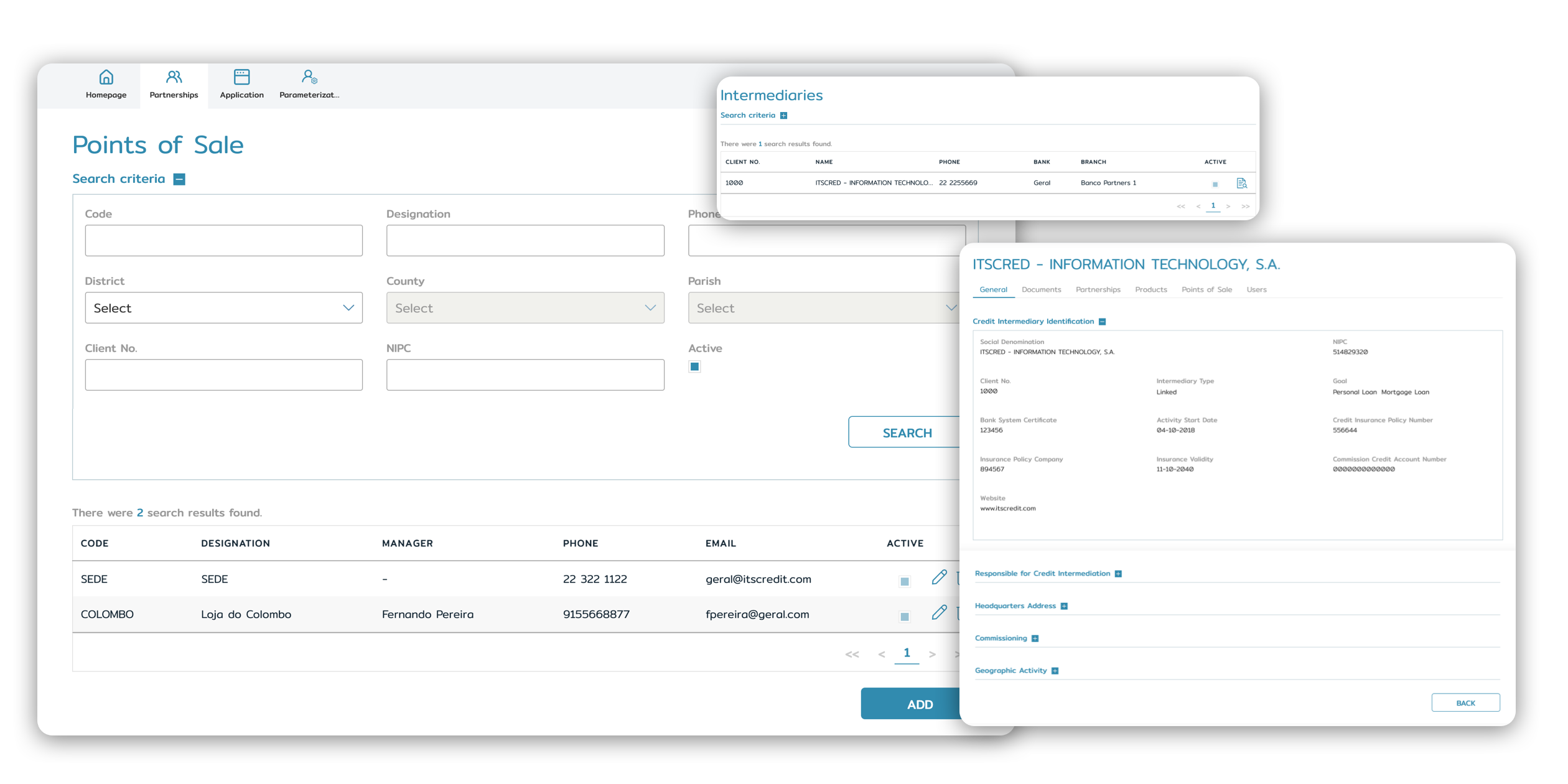

Partners’ management

Configure and manage your partners’ (Real Estates, Travel Agencies, Car dealerships…) intermediaries, partnerships, points of sales, fees, users and credit application status.

-

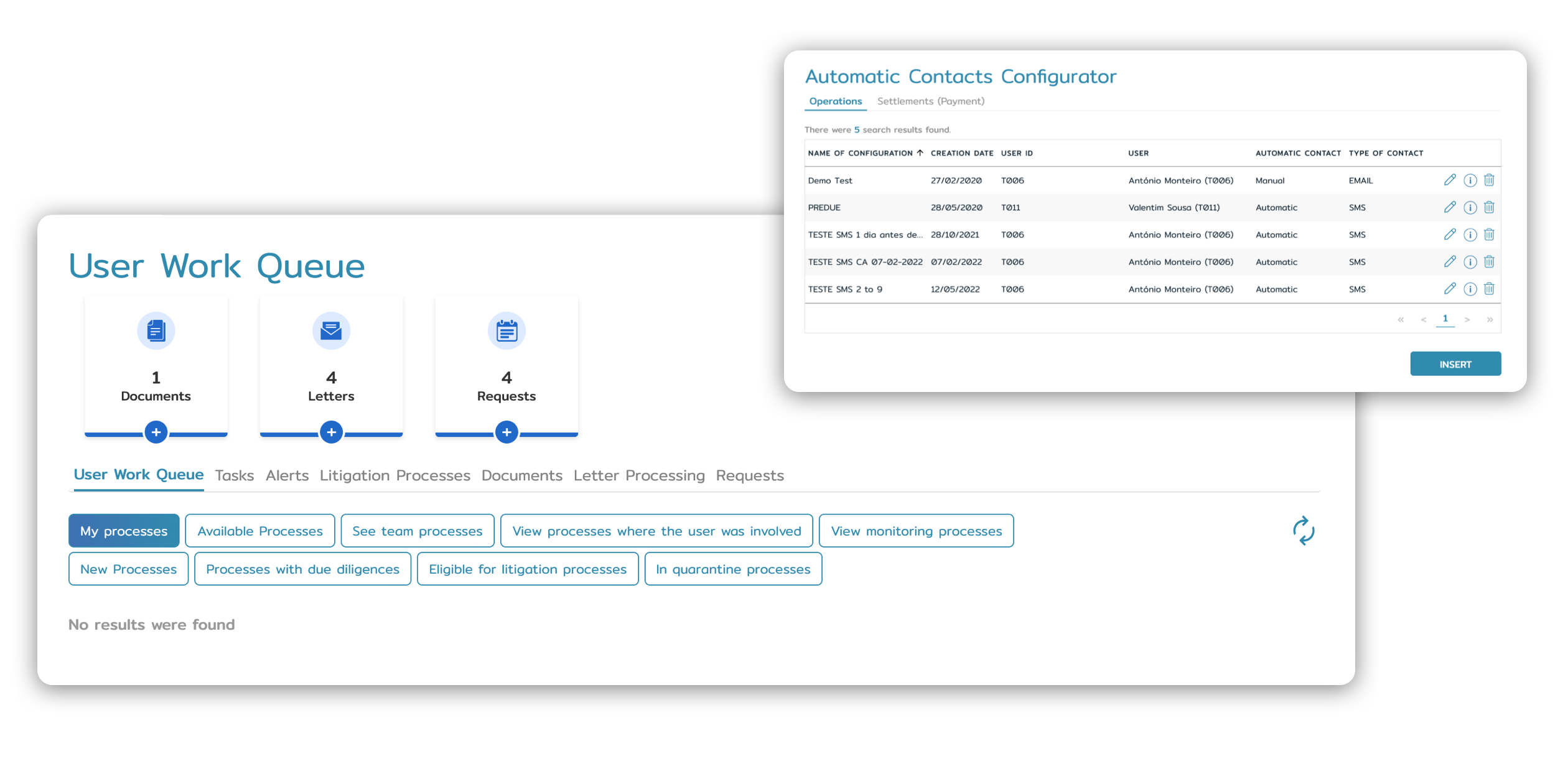

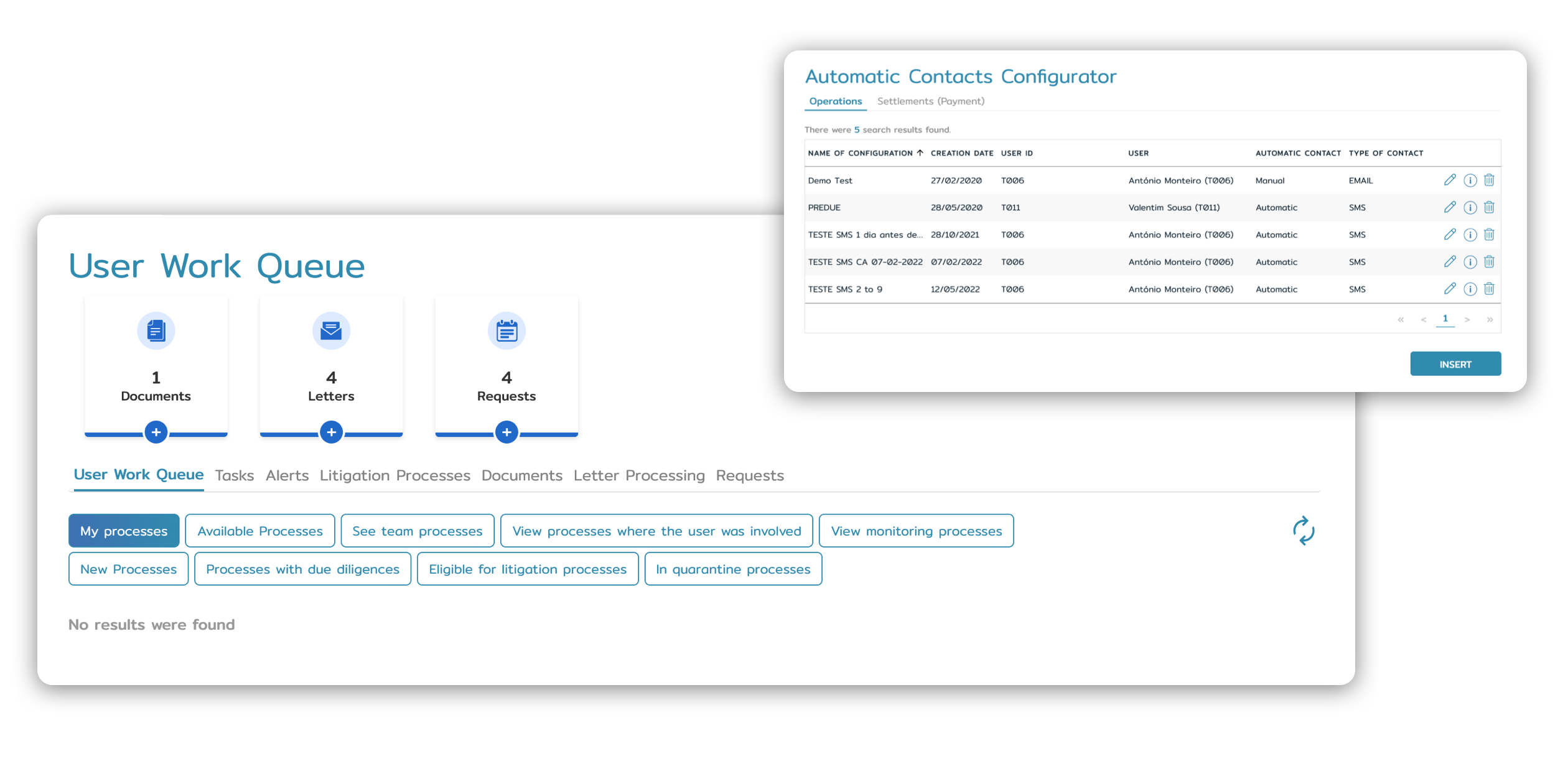

Credit recovery

Integrated with the collections module, the lender can have a centralized management of the credit in arrears and manual and both automatic communications with customers that have overdue credit installments.

The credit functionalities are open to partners through API’s and widgets that they can integrate within their own systems and interfaces

Highly flexible and easy to use Marketing module (within Credit Workflow) allowing product teams to create and manage new innovative products without IT support.

To non-customers, the user can create a new account, inserting his personal and financial data which will be automatically validated to prevent frauds.

Configure and manage your partners’ (Real Estates, Travel Agencies, Car dealerships…) intermediaries, partnerships, points of sales, fees, users and credit application status.

Integrated with the collections module, the lender can have a centralized management of the credit in arrears and manual and both automatic communications with customers that have overdue credit installments.

“Customers' payment preferences have shifted in recent years. They want to have the flexibility of reviewing the product first and only then fully engaging their funds. At BLIK, we are fully aware of these needs and introducing functionality of BNPL is one of our key strategic decisions. We are pleased that ITSCREDIT supports us in this project. Software delivered by this partner is one of the advantages that will help us gain satisfying market shares in BNPL’s industry.”

Start Now. Expand your credit business while boosting customer satisfaction.

Our Solutions

Highly configurable software credit solutions that increase a bank's profitability and productivity while addressing today's banking challenges and opportunities.