Trusted by clients all over the world:

A 360º smart credit platform, powered by AI

To stay ahead, you need smooth, risk-free credit assessments. ITSCREDIT's smart lending platform does just that. Our cloud-based loan management software handles everything from loan origination and risk management to credit monitoring and recovery.

Identity verification, decision-taking and risk prediction within seconds—faster than a phone call

Smart lending by experts,

powered by AI

Can your organisation afford delays? Our AI lending platform gives you a full view of a borrower's credit score, payment history, and simulations in real time.

loan leads

With high-quality, targeted lead lists prioritised for their loaning potential.

time-to-market

Through swift data analysis, accurate risk assessment, and fast decision-making.

loan volume

By enhancing cross-selling opportunities and creating personalised offers.

operating costs

Via automated data analysis and decision-making, faster processes and less manual effort.

Seamless risk, scoring

and fraud detection

Create and customise Scoring, Rating, and Early-Warning models

effortlessly with our all-in-one AI lending platform. Harness automation

to get precise borrower risk assessments in real-time, spot potential

financial issues early, and speed up confident decision-making.

.webp?width=1747&height=979&name=Property%201=Default%20(1).webp)

Flexible deployment across

all branches and systems

Take full advantage of our Infrastructure as a Service loan

management software to smoothly integrate with your current

credit scoring, product apps, and external platforms and meet

local regulations.

.webp?width=1746&height=979&name=Frame%201321316874%20(1).webp)

Simplified compliance with automated checks and monitoring

Digitise and automate the entire credit risk management process to simplify compliance, meet regulations, and avoid the pitfalls of managing multiple apps and running manual,

error-prone processes.

"The introduction of ITSCREDIT in Credito Agricola's digital channels represents another step towards our adaptation to the digital business and an approach to business models that aim to meet the profiles of a new generation of customers who increasingly prefer to relate to a bank in a practical, fast and innovative way, rather than the traditional physical presence and consequent travel to the bank's branches."

Licinio Pina | Grupo Credito Agricola's President

“Customers' payment preferences have shifted in recent years. They want to have the flexibility of reviewing the product first and only then fully engaging their funds. At BLIK, we are fully aware of these needs and introducing functionality of BNPL is one of our key strategic decisions. We are pleased that ITSCREDIT supports us in this project. Software delivered by this partner is one of the advantages that will help us gain satisfying market shares in BNPL’s industry.”

Witold Litaszewski | Head of BNPL at BLIK, Polish Payment Standard

"Having worked with various systems but have never come across one that is easy to use and navigate and one that delivers what the vendor sold during their sales pitch. Flowcredit is a very user-friendly and flexible system. As demonstrated by the number of other systems, it can integrate with giving the user an end to end product that is desirable."

Naboth Orieko | Stanbic Bank Kenya's Head of Personal Banking – Credit

“We adopted ITSCREDIT's platform for managing the credit process in the retail segment. It's a platform that combines different channels, currencies, products and segments allied with the automatic decision scoring model has given us a significant reduction in 'Turnaround Time' and a considerable increase in the volume of leads and loans.“

Adriana Martins | Absa’s Head Of Retail & SME Credit Risk

Your go-to tools for stress-free lending

Explore our complete suite of tomorrow's smart lending tools for today's peace of mind.

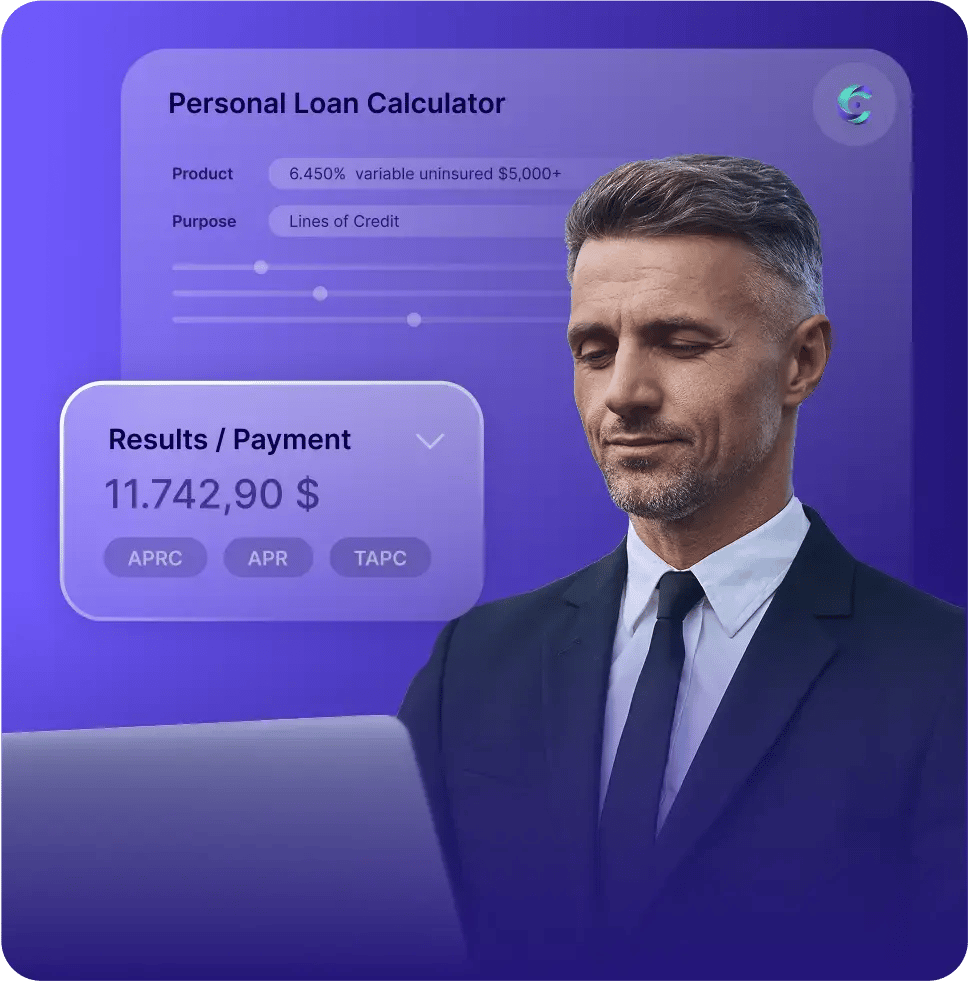

Take control of your credit solutions with our 100% online credit risk calculators.

- Instant alerts about any changes affecting the scoring.

- Reliable, up-to-date scoring data with calculators linking directly to your product catalogue across different channels.

- No need to log in to kickstart the customer journey, handling simulations, pre-approvals, and proposals, and revisit previous simulations.

Make informed decisions based on last-minute data from AI-based scoring models tailored to your needs.

- Simple but powerful customisation options supporting multiple variables and product-specific scoring models.

- Error-proof model validation, analytics, and tests for top scoring accuracy.

- Hands-free scoring, instant calculations, faster credit decisions.

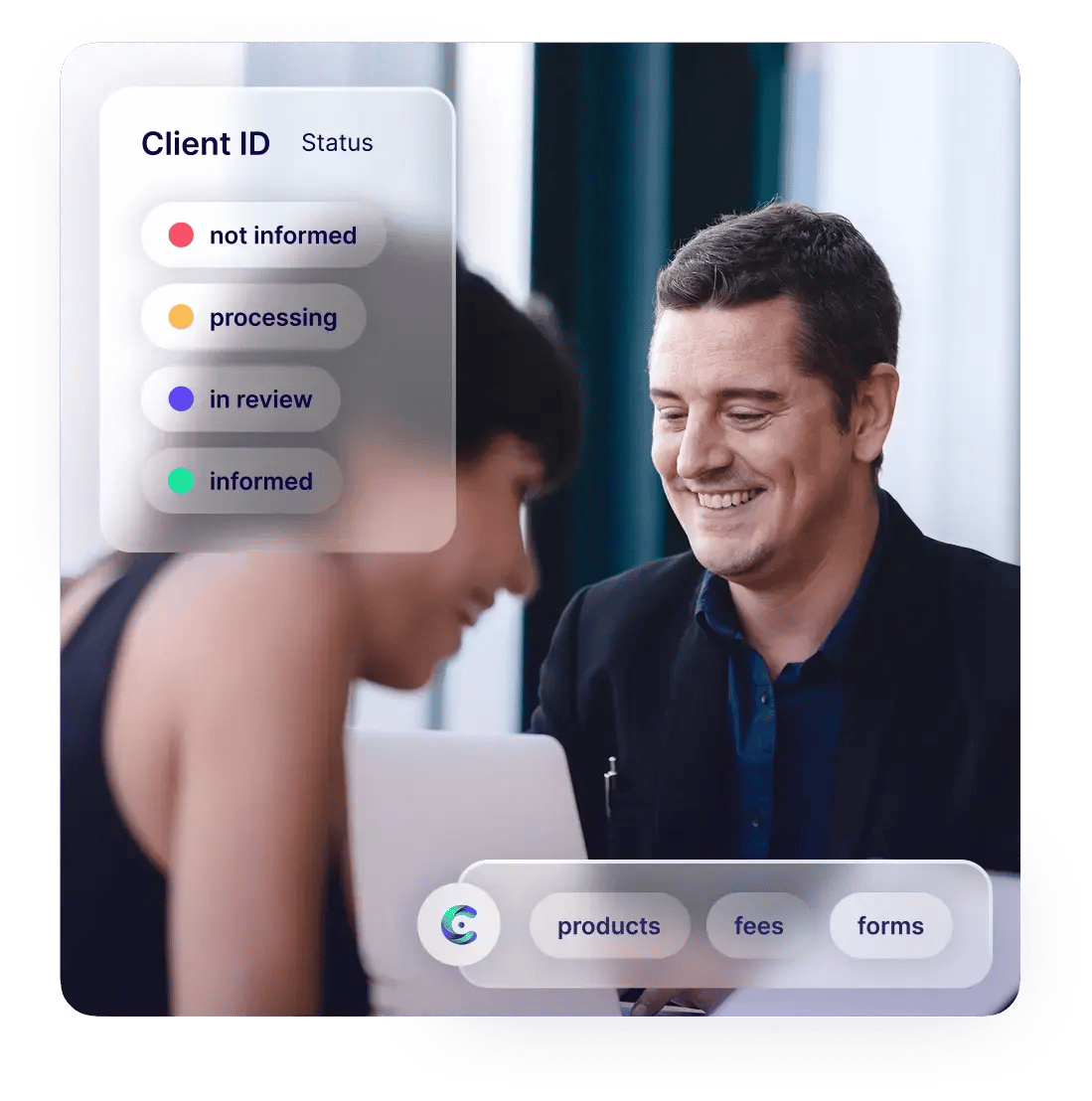

Use tools that will bring every stage of credit origination up to speed effortlessly.

- AI- and machine learning-powered task automation for better prediction, scoring, and pre-approval.

- Seamless loan process thanks to centralised records synced between all financial data bases.

- Streamlined task management features easily configurable for any credit workflow.

.webp?width=1029&height=981&name=c%20monitoring%20(1).webp)

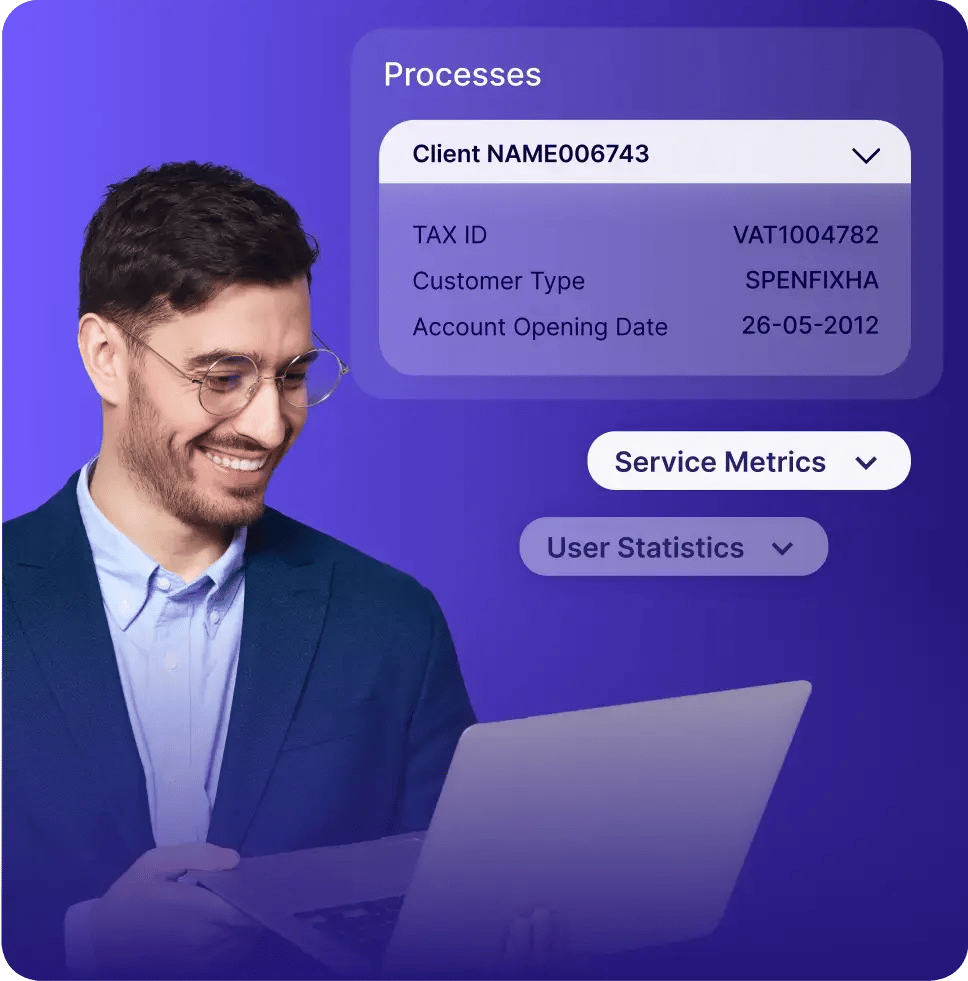

Get all tools to analyse credits scores, assess risks, and receive instant alerts—all in one dashboard with a full view of your portfolio.

- Fully automated and configurable monitoring and instant warnings about early signs of financial difficulties.

- On-the-spot financial reports presented visually through ready-made graph templates and dashboards.

- Precise credit simulations adjustable to forecast any scenario.

Smoothly manage your collection workflow process automation, and task management.

- APIs and data integration for fast, seamless exchange of debt records with third-party partners.

- Intuitive interface, centralised documentation, monitoring, and task management features.

- Faster loan recovery thanks to automated communication and custom collections strategies.

us simulations.