Real-time,

complete loan data, just a click away

Make the most of live

credit records

Successful credit collection relies on the latest loan, arrears, and financial information. By connecting directly to your core banking system, our credit collections module constantly pulls the most up-to-date records and keeps your database updated in real time.

Connect with

third-party agents

Via APIs, you can easily exchange data with external partners like legal departments, contact centres, debt collection agencies, insurance companies, and more.

Make data accessible

Data filters and centralisation allow your team to instantly browse and find the information necessary for reporting, monitoring, and analytics.

Collections tasks management easier than ever before

Coordinate collections processes

Our credit collection system empowers your recovery team through work queues, tasks, and alerts. Monitoring tools help you track the performance of each user based on SLAs to effortlessly achieve company goals.

Optimise your workspace

The Collections System hub's intuitive interface enables users to quickly access information, documents, and activities. Its customisable layout allows every team member to maximise it for their needs.

Expedite document-based workflows

Thanks to built-in functionalities for agreements, PTPs, action plans, and write-off management, our tool for credit collection can become your one-stop hub for credit recovery records and processes.

Automation

+ customisability

= a winning credit recovery strategy

Automate customer communication

Relieve your credit recovery team by relegating communication with borrowers to Collections System. Send automated reminders, notifications, and follow-ups through various channels like SMS, emails, and letters.

Handle credit restructuring quickly

Our credit collection tool syncs with the Loan Origination module to calculate a new payment plan and automatically create new applications or start a write-off process.

Tailor your credit recovery strategy

Configure contact criteria and process assignment rules to your needs. Combine automated and manual communication across rehabilitation and litigation stages. Use Collections System's flexibility to craft a credit collections strategy that meets your unique requirements.

How it works?

From data integration to write-off, Collections System streamlines every

stage of the credit collections process

Data import

ITSCREDIT's credit collection module receives batch data from the core

banking system with loans in arrears.

Task assignment

The solution automatically creates and assigns a collection task to a user's

work list.

Rehabilitation phase

Collections Systems initiates automated or manual contact workflows following the configured criteria through SMS, phone calls, or letters.

Configurable daily SMS sent until instalments are paid, updated with real-time loan information.

Automatic outbound or click-to-dial phone calls. Users receive status confrimation before the call begins and can register the outcome using a pre-defined, configurable list of results.

Letters, written manually, based on templates, or automatically generated.

Letter settings can be configured in the system.

Action plan and credit

restructuring

Action plan and credit

restructuring

Recovery phase

During the recovery phase, Collections System assists your team with lawyer

and agreement management, process

distribution, and legal events and cost

input.

Declared

non-collectable

Declared

non-collectable

Write-off phase

Once the debt is considered non-collectable, Collections System helps

your team with write-off agreement management and recovery events.

The definitive suite of

credit collection tools

Our credit collection tool syncs with the Loan Origination module to

calculate a new payment plan and automatically create new applications

or start a write-off process.

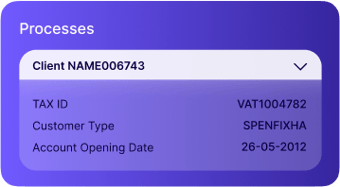

Process Integrated view

Quickly search and retrieve specific processes based on various criteria. Access relevant information with ease, saving time and effort in the collections process.

Process Details

Gain a holistic overview of a process by accessing integrated information. See

customer details, financial history, and communication records in one consolidated view.

Tasks and Alerts

Assign tasks and set up alerts to keep your collection team on track. Stay organized and never miss important deadlines or follow-ups.

Communications Results

Tracking

Record the outcomes of each customer contact made during the collections

process. Keep track of agreements, payment arrangements, and customer responses.

Address and Contact

Management

Maintain accurate records of customer addresses and contact information. Easily update and manage contact

details to ensure effective

communication.

Periodic Integration of

Contracts in Default

Seamlessly integrate and monitor defaulted contracts on a regular basis, updating it with the latest information

to drive effective recovery strategies.

Designed for ease of use

Our Collections System focuses on making things easy for you. It helps

your recovery team quickly find the info they need and handle tasks

smoothly, speeding up the whole process.

Easy-to-use,

personalised User Dashboard

Enjoy a personalised hub that puts everything you need right at your fingertips. With just a quick look, you can see all your assets in one place. From work queues to documents and key metrics, it’s all there to help you stay on top of things:

Switch between different views like User’s Processes, Team Processes, New Cases, and Cases with Due Diligence, so you can easily focus on what matters most and get things done faster.

Recovery Performance Reports

Your go-to hub for tracking how well your credit recovery is doing. Get all the details you need in one spot—see how your recovery rates are shaping up, understand your success stories, and dive into key metrics effortlessly, all in one place.

End-to-end credit platform

Looking for smarter ways to streamline lending? Explore our other products

Calculator

Run accurate simulations for all financial products, channels, and partners in a single online tool.

Scoring

& Credit Decisions

Validate, configure, and refine your scoring models for faster credit assessment.

Credit Workflow

Easily manage every step of loan origination, from application to the final decision.

Credit Monitoring

& Risk Analysis

Anticipate risks, discover portfolio insights, and run pricing and profitability analyses.

.png?width=835&height=586&name=Group%20238105%20(1).png)